Hourly wage calculator us

See where that hard-earned money goes -. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working.

Hourly To Salary What Is My Annual Income

Her average wage is 22 per hour.

. Determine how many hours you will work in a year. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. The state tax year is also 12 months but it differs from state to state.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. United States Hourly Tax Calculator 2022. Hourly pay Monthly salary 12 Hours worked per week Weeks per year.

Next divide this number from the annual salary. This page includes the United States Hourly Tax Calculator for 2022 and supporting tax guides which are designed to help you get the most out. As an example if you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre-tax will.

To calculate your hourly wage based upon your annual salary start by dividing your salary figure by the number of hours you work per week. Learn more about our global salary comparison and data tool. First enter your Gross Salary amount where shown.

Ad Easy To Run Payroll Get Set Up Running in Minutes. - In case the pay rate is hourly. Based on this the average salaried person works 2080 40 x 52 hours a year.

Payroll So Easy You Can Set It Up Run It Yourself. Example annual salary calculation. Take A Guided Tour Today.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Some states follow the federal tax. US Hourly Wage Tax Calculator 2022.

Taxes Paid Filed - 100 Guarantee. Using the United States Tax Calculator is fairly simple. The hourly rate calculator will help you see what that wage works out to be.

This places US on the 4th place out of 72 countries in the. Taxes Paid Filed - 100 Guarantee. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

1950 hours are worked in a year if you work 75 hours per day five days. Families and individuals working in low-wage jobs make insufficient income to meet minimum standards given the local cost of living. Paycors Full Suite Of HR Solutions Modernizes How Organizations Manage Their People.

Lets say you earn 2500 per month and work 40 hours each. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. How do you calculate hourly rate from annual salary.

You may use a common formula. This federal hourly paycheck. Sara works an average of 37 hours per week and takes two weeks off per year.

To determine your hourly wage divide your. Then divide the resulting figure by the. The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States.

Next select the Filing Status drop down. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As a simple rule of thumb.

ERIs Global Salary Calculator. Ad See Why 40000 Organizations Trust Paycor. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

What is her estimated annual income. By default the US Salary. How to use the Hourly Wage Calculator.

B Daily wage GP WPD C Weekly wage GP WPD WDW D Monthly wage E 12 E. A Hourly wage is the value specified by the user within GP. The average full-time salaried employee works 40 hours a week.

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour. The final figure will be your hourly wage. Wondering what your yearly salary is.

Determine competitive salary ranges for positions worldwide with ERIs Global Salary Calculator. WHAT IS THE LIVING WAGE CALCULATOR. Using the United States Tax Calculator.

Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours.

Hourly Rate Calculator

Are You Ready To Calculate Your Real Hourly Wage Google Sheet

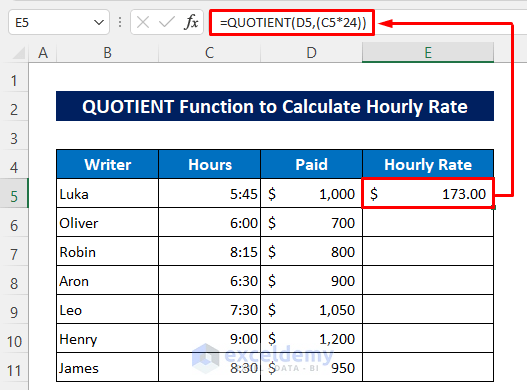

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator

Overtime Calculator

Overtime Pay Calculators

Annual Income Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly To Salary Calculator Convert Your Wages Indeed Com

Salary To Hourly Calculator

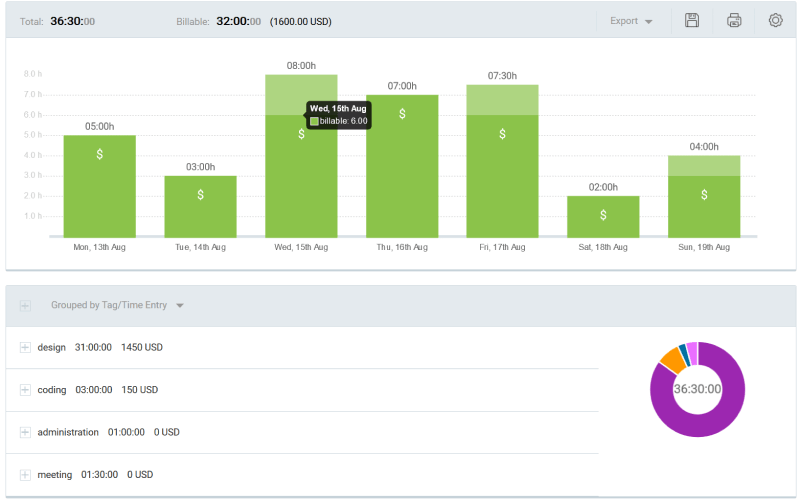

Calculators Annual Salary Calculator Billable Hours Head Hour Rate

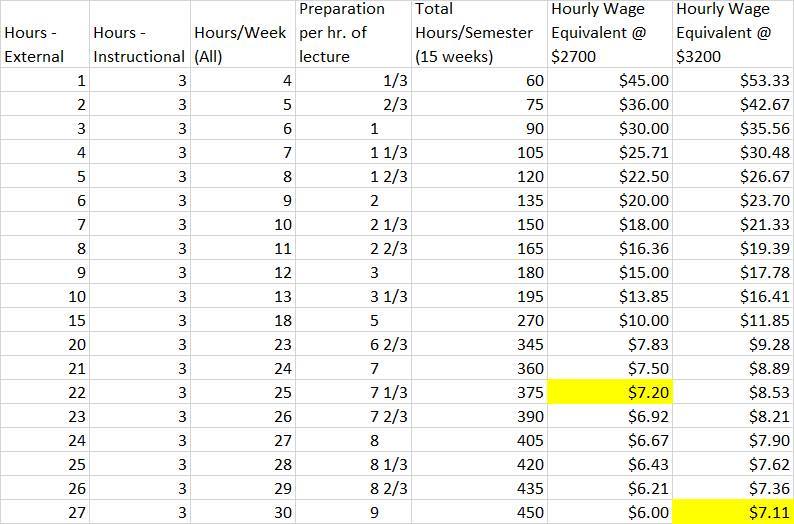

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Hourly Paycheck Calculator Step By Step With Examples

Hourly Rate Calculator

Hourly Rate Calculator

Wages And Salary Calculator